The board has decided to increase pensions on 1 January 2024.

On 21 November 2023, the board decided to increase pensions by 5.3 % as of 1 January 2024. The increase is the same for all members. The accountability body issued a positive recommendation on this matter on 5 December 2023. Below, we provide an explanation of the decision.

Regular supplement as of 1 January 2024

In the allowance policy, the allowance benchmark is the consumer price index (CPI) for all households from October to October. The allowance benchmark is the maximum allowance that may be granted if the coverage ratio is high enough. For this year, the allowance benchmark is -0.4%. Based on this, no supplement is possible. The CPI is negative, despite the fact that prices have risen, because in October 2023, Statistics Netherlands calculated the CPI differently than in October 2022. The new method measures energy prices differently.

Because Statistics Netherlands has changed the way it calculates the CPI in the interim, it is permitted to calculate the CPI for October 2022 using the new method. The board is making use of this option. The supplement benchmark will then be 5.3 % instead of -0.4 %. Based on the coverage ratio and the rules for future-proof indexation, a supplement of 1.7 % is then possible.

More information about the adjustment of the consumer price index can be found on the CBS website in the article CBS switches to new method for energy prices in the CPI.

Additional supplement as of 1 January 2024

Last year, the Minister offered the possibility of applying more generous conditions for granting supplements. This was set out in an Order in Council. A supplement may be granted from a coverage ratio of 105 % instead of 110%. And the requirement for future-proof indexation lapses if the coverage ratio does not fall below 105 % as a result of the supplement being granted. Based on these more generous conditions, pensions at the Witteveen+Bos Pension Fund were increased by 5 % as of 1 January 2023.

The more generous conditions have now been extended until 1 January 2024. This means that our fund can again make use of these conditions this year and that an additional supplement of up to 3.6 % is possible. The total supplement (the sum of the regular supplement and the additional supplement) amounts to a maximum of 5.3 %. This is equal to the aforementioned supplement benchmark.

Effect on different age groups

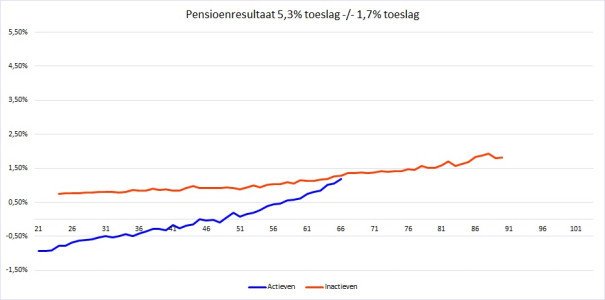

The board commissioned consultancy firm Sprenkels to investigate the consequences of an additional 3.6 % supplement. The consequences for the various age categories are shown in the following graph. This shows the effect of the additional surcharge on the pension result for all ages. For older employees, the additional surcharge has a positive effect on the pension result. For younger employees, the additional surcharge has a negative effect on the pension result. The tipping point is around 46-48 years of age. The negative effect is greatest for employees aged 21: approximately 1 %. For all inactive persons, a higher supplement has a positive effect on the pension result. This positive effect increases with age.

Risk of reductions when switching to the new pension scheme

Sprenkels has also calculated the probability that pensions will have to be reduced when the new pension scheme comes into effect on 1 January 2026 because the funding ratio will be too low. The results of this calculation are shown in the table below. A higher supplement increases the probability of an insufficient funding ratio. With a supplement of 1.7 %, there is a 7.0 % chance that the coverage ratio will be lower than 105 %. With a supplement of 5.3 %, this chance is 10.7 %.

Consideration by the board

Based on the analysis, the board has concluded that the negative effect on the pension results of young people is limited. The increase in the likelihood of reductions due to an insufficient coverage ratio is also limited. In light of the increased prices and the increased coverage ratio, the board therefore considers an additional supplement of 3.7 % to be justified, balanced and in the interests of employees, former employees and pensioners. With the regular supplement of 1.7 % as of 1 January 2024, the total supplement will then be 5.3 % as of 1 January 2024. PF W+B's mission is to provide the best possible pension with a balanced equilibrium between level, stability and predictability. The board believes that a supplement of 5.3 % will achieve the desired balance in the mission.

Finally, if you have any questions, please feel free to contact the pension fund secretariat by sending an email to secretariaatpensioenfonds@witteveenbos.com.